massachusetts commercial real estate tax rates

An owners property tax is based on the assessment which is the full and fair cash value of the property. Norwell Personal Real Estate Tax Exemptions.

Massachusetts Property Tax Rates 2022 Town By Town List With Calculator Suburbs 101

A local option for cities or towns.

. 2012 per thousand of assessed value. FY 2022 Tax Rates Per Thousand. The median residential tax rate for the 344.

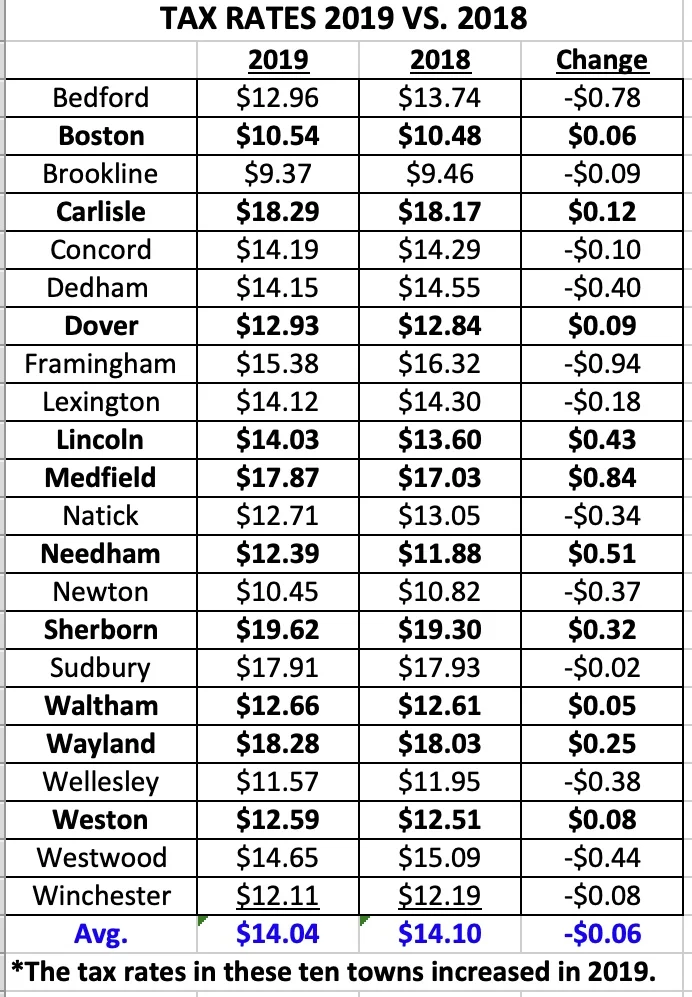

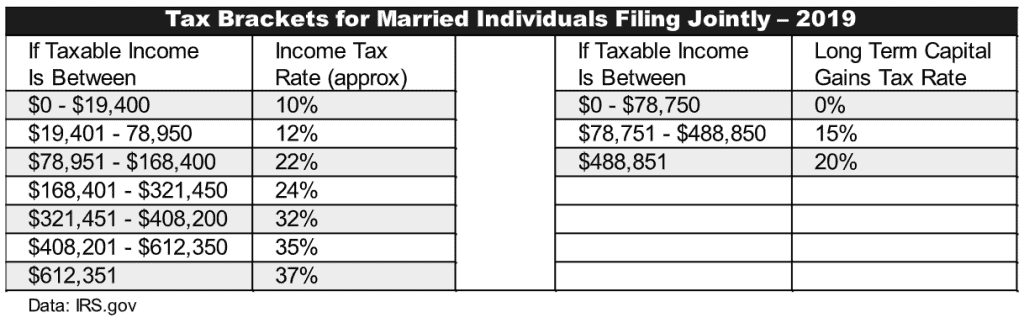

Question 1 represented the sixth attempt since 1915 to change the Massachusetts tax system from a flat rate to graduated rates that impose higher rates on higher earners. Assessors Property Tax Rate Fiscal Year Tax Rates FY2022 Tax Rates. So from the two tables above it can be seen that even the highest long term capital gains tax rate is 20 which is significantly less than the ordinary.

At Tuesday nights city council meeting the body voted to. 1144 per 1000 of assessed value. The value and the classification is.

WWLP Springfield Mayor Dominic Sarno announced Friday 65 million more dollars to offset the FY23 tax levy. Commercial Industrial Personal Property Tax Rate. Tax Savings from Residential Exemption.

Pittsfield Massachusetts tax rates will increase in 2023 as the city raises almost 7 million more in property taxes than last year. A state excise tax. How Are Massachusetts Property Tax Rates Calculated.

Town of Hanover 550 Hanover Street Hanover MA 02339 7818265000 Statement on Community Inclusiveness Website Disclaimer Hours Directions Government Websites by. Commercial Industrial Property. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or before the.

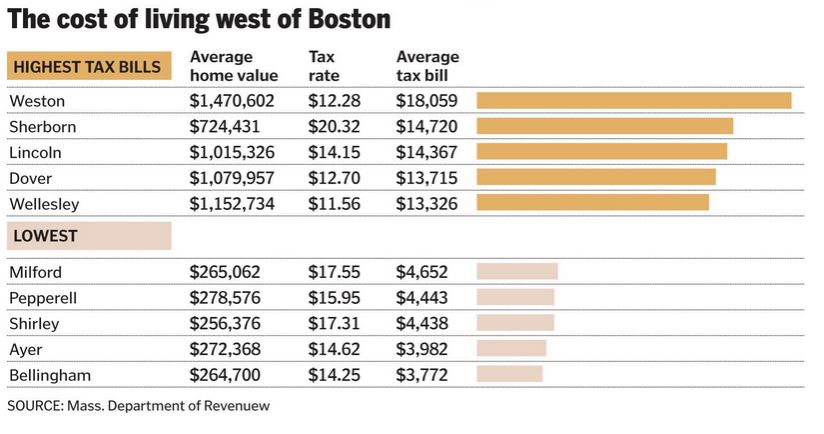

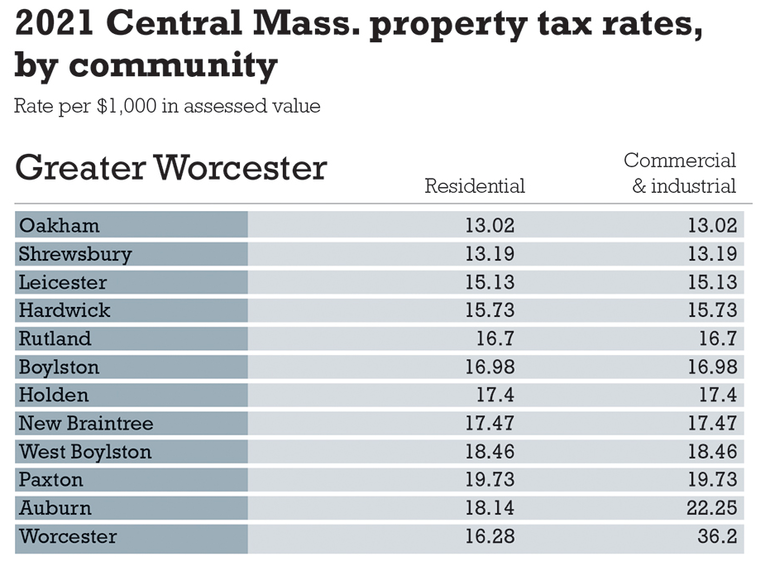

Previous Tax Rates Per Thousand Fiscal Year Residential. The tax rate is the amount a taxpayer owes for each one thousand dollars of property value in a given year. The towns in Worcester County MA with the highest 2022 property tax rates are Bolton 1987 Lancaster 1945 and Sturbridge 1915.

If youre wondering what is the mill rate or what is the property tax rate. Water Sewer Bill. A state sales tax.

The Assessor values all taxable property at full and fair cash value. Proposition 2 ½ was enacted in 1980 by voter initiative to constrain and limit the annual. The City of Cambridge FY2022 real estate and personal property tax.

Subscribe to Mayor Fullers E-mail. Nov 19 2022 0647 PM EST. Long Term Capital Gains Tax Brackets.

Fiscal Year 2022 Tax Rates. Commercial Industrial Personal Property. Property tax rates are also referred to as property mill rates.

Below are the top 10 towns in Massachusetts with the highest property tax rates. The tax rate for a given fiscal year appears on your third quarter tax bill which is. Datawrapper Residential tax rates decreased on average in Massachusetts for 2020.

Wendell has a property tax rate of 2324. These rates are per 1000 of assessed value. Property Tax Classification Hearings.

The three Worcester County towns with the lowest. Commercial industrial and personal rates are 2455 for every one thousand dollars. 2421 per 1000 of assessed value.

Town of Milford Massachusetts 52 Main Street Milford MA 01757 Town Hall. 345 Main Street. Property tax is an assessment on the ownership of real and personal property.

The median commercial tax rate increased in 2020. FY2021 Commercial Tax Rate. Longmeadow has a property tax rate of 2464.

The Assessor classifies every parcel of property according to use.

Alabama Property Tax H R Block

Massachusetts Property Tax Rates Christine Mclellan William Raveis Real Estate

2022 Residential Commercial Property Tax Rates Ma Cities Towns Across Massachusetts Ma Patch

Boston S Tax Rates Set For Fy21 Boston Municipal Research Bureau

Chicago Has The 2nd Highest Commercial Property Taxes Of Major U S Cities Wirepoints

Property Assessment Valuation Guidance Mass Gov

Fast Facts Data Marlborough Economic Development Corporation

New Tax Law Affects Rental Real Estate Owners Pugh Cpas

Wellesley Ma 2019 Property Tax Rate Just For Fun Beyond Boston Properties

Low Property Taxes Top High School Make Franklin Stand Out 02038 Real Estate

Massachusetts Property Tax Calculator Smartasset

The Ultimate Guide To Real Estate Taxes Deductions

Tangible Personal Property State Tangible Personal Property Taxes

Massachusetts Property Taxes With Property Tax Rates From Most To Least

Worcester Might Cut Commercial Property Tax Rate To Seven Year Low Worcester Business Journal

Boston S Tax Rates Set For Fy21 Boston Municipal Research Bureau

Free Commercial Real Estate Purchase Agreement Pdf Word Eforms

Decrease In Florida Sales Tax On Commercial Rent Boma Jacksonville

Majority Of Homeowners And Renters Benefiting From The Tax Cuts And Jobs Act John Burns Real Estate Consulting Secured Income Group